How PNB-PAL can do better with their co-branded cards

- Jun 12, 2021

- 5 min read

It's been no hiding the fact that Philippine Airlines and Cebu Pacific are direct competitors despite PAL being a full service airline and Cebu Pacific being a budget airline. They share the market on majority of their routes with the exception that PAL flies to North America and the UK.

Despite being direct competitors, Cebu Pacific has found a way to capture the less known type of savy/frugal traveler, and no I don't mean those who always book the Piso fares lol. These travellers rely on a different type of currency and that is airline miles.

How you may ask? Credit cards.

Aside from the traditional way of earning miles, which is by actually flying, credit cards and co-branded credit cards actually generate more miles than from actually flying. Especially now during the pandemic. People have been becoming more aware of using miles for travel over the past few years and loyalty programs have taken notice by adding new ways to earn, adding new program partners and so on.

Photo from PNB

Let's not forget that these loyalty programs are legitimate businesses and earns a lot more than we think they do. Remember airline miles are a type of currency and each mile has a corresponding peso value to them.

Something that almost never gets talked about but is one of the biggest ways airlines make money is by actually selling airline miles to banks. By having a co-branded card with a partner bank, the airline should be able to make significant revenue from selling miles to the bank on a consistent basis.

The co-branded cards

Cebu Pacific has done an amazing job with it's GetGo co-branded credit cards with UnionBank. A lot of millennials especially those from the middle class workforce have been really enticed to apply for one of their cards and for good reason too!

Both Cebu Pacific GetGo Platinum and Gold co-branded credit cards give a spend to mile ratio of ₱30 = 1 GetGo point with the Platinum variant giving extra perks such as priority check in, extra baggage allowance, and lounge access to name a few.

Note: GetGo is transitioning to Go Rewards and will finalize its transition on July 26, 2021

Philippine Airlines on the other hand has some very disappointing co-branded cards. They have 3 co-branded credit cards and 2 co-branded debit cards with PNB. I won't go over the debit cards because they have dismal earn rates of ₱200 and ₱250 spend per 1 Mabuhay Mile.

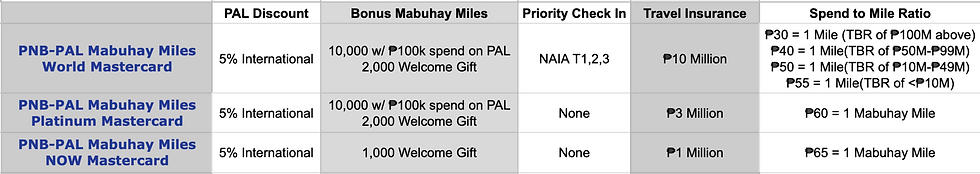

Actually to be honest the earn rate of the credit cards are quite dismal as well. Here is a chart I made of some card details worth noting.

*TBR = Total Banking Relationship

PAL discount is only selected flights

Whats wrong with the credit cards?

First and foremost, the spend to mile ratios are depressing to look at. Just to match the spend to mile ratio of Cebu Pacific's cards you need to have at least ₱100 million in your bank accounts with PNB!!! Crazy! Even the already high ₱50 = 1 mile you need at least ₱10 Million, which most of us don't have.

The other 2 credit cards don't have TBR requirement but the spend to mile ratio is way too high and it'll take way longer to actually be able to redeem for free flights.

Did anybody say lounge access? "We don't do that here" -T'Challa

How can you call it a premium travel credit card if you don't provide any lounge access with the card??? I can understand the lower tiered cards not having any but you would have to expect it with the World Mastercard especially with the ridiculous TBR requirements.

Only the World Mastercard gives priority check in and only in NAIA??? What about all other international airports like Mactan Cebu, Francisco Bangoy, or Clark? This is quite mind boggling since all these airports are major economic hubs aside from the fact that they are international airports.

The bonus miles of 10,000 Mabuhay Miles is nice, but maybe if it wasn't so hard to attain it would have been good. If you're not flying long haul on PAL twice a year roundtrip then the only way to get this bonus is by always flying business class on short to medium haul flights.

The 5% discount is nice too, but only for international flights? And only on selected flights? The face palm emoji would be a good way to describe how I feel about this.

What PNB-PAL can do to improve their credit card products

There are lots that can be improved with the cards and stay competitive with Cebu Pacific. First and foremost they have to somehow offer a better spend to mile ratio. I'm not asking it be the same as the GetGo cards of ₱30 per mile, but somewhere at least ₱45 or below per mile would at least make it more enticing.

If they want to threw in any kind of category multipliers that would be a HUGE plus too.

Next we need the World Mastercard variant to at least have some form of complimentary lounge access. Doesn't have to be unlimited lounge access but maybe at least twice per year should be the bare minimum. Totally unacceptable as a premium travel credit card with none at all.

The welcome bonus of 2,000 Mabuhay miles could be a bit higher and maybe instead of the 10,000 miles bonus from ₱100k spend on PAL they change it so just regular spend, which would make more sense and make consumer use the card more.

I would say the PAL ticket discounts of 5% is just right but they have offer it on domestic flights too even if you have to put some restrictions.

Travel insurance is the one area they are doing alright.

Bottomline

Philippine Airlines have been struggling heavily as with most of the airlines during the pandemic, but they could have gotten some financial gain if they had better co-branded cards. Same can be said of PNB as more people using their cards means more merchant fees for them to collect.

Both companies have the same owner should even make it easier to offer better co-branded cards.

I personally love flying with PAL and would not hesitate to get one of their co-branded credit cards should they improve the benefits in the future, specifically the spend to mile ratio. As of now they just aren't worth getting when I have other better mile earning cards.

The fact that AirAsia's co-branded credit card with RCBC is even a better option right now should say something.

I've also got to give the marketing teams of the GetGo's co-branded cards some credit as well for really putting the cards out there into the public's eye. PNB and PAL have some work to do if they want to keep up.

Check out The Points Society playlist on Youtube.

Comments